The tale of the mighty Automatic Stay in bankruptcy cases!

The Automatic Stay is a powerful legal tool that comes into play the moment a bankruptcy petition is filed. It’s like a legal force field that protects debtors from the unrelenting onslaught of creditors who seek to collect their debts by any means necessary.

Imagine, if you will, a debtor drowning in a sea of debt. The creditors are like sharks circling around, ready to pounce at the first sign of weakness. But fear not, for the Automatic Stay is here to rescue our debtor from certain doom.

With the Automatic Stay in place, all collection activities must come to a screeching halt. Creditors are prohibited from calling, sending letters, or taking any legal action against the debtor. No more incessant phone calls, no more threatening letters, no more sleepless nights.

But wait, there’s more! The Automatic Stay also puts a stop to any ongoing lawsuits, repossessions, foreclosures, and wage garnishments. That’s right, the Automatic Stay is like a legal superhero, swooping in to save the day and give the debtor a fighting chance to get back on their feet.

Of course, like any superhero, the Automatic Stay is not invincible. There are some exceptions to its power, such as certain criminal proceedings or actions by the government to collect taxes. But for the most part, the Automatic Stay is a potent shield that can give debtors the breathing room they need to reorganize their finances and get a fresh start.

So, in conclusion, I implore you to embrace the Automatic Stay as a powerful legal tool that can save debtors from the clutches of their creditors. Let us all raise our glasses and toast to the Automatic Stay, defender of debtors, champion of justice!

If you find yourself drowning in debt and struggling to keep up with your financial obligations, don’t despair. The Automatic Stay in bankruptcy cases can be a powerful tool to protect you from the harassment of creditors and give you the breathing room you need to get back on your feet.

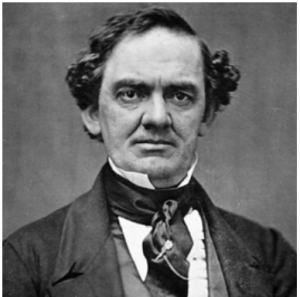

To learn more about how the Automatic Stay can help you, I encourage you to schedule a free telephone consultation with Attorney Irby at 256.882.2222 or by using the appointment scheduler link found on Bankruptcy.Solutions. With his years of experience in bankruptcy law, Attorney Irby can help guide you through the process and help you achieve a fresh start.

Don’t let debt continue to control your life. Contact Attorney Irby today and take the first step towards financial freedom.